Table of Contents Show

What is the Smart Platina Assurance Plan, who is eligible, what are its features, benefits, decreased paid-up value, and surrender value?, SBI life smart platina assure plan details, eligibility criteria, benefits, reduced paid-up value and Surrender value.

It is vital to make a sensible investment choice in order to save the proper amount of money. And put your money where there is less chance to lose it.

You can invest in SBI Life – Smart Platina Assure Insurance if you too wish to invest in the best spot to save money for yourself. where you can save money and receive life insurance as well as many other advantages.

Tell us about the SBI Life Smart Platina Assurance Plan and its features and advantages.

What is SBI Life – Smart Platina Assure?

A non-linked, non-participating life endowment assurance savings product from SBI Life is the Smart Platina Assure Plan. This also includes guaranteed-return life insurance.

This insurance policy offers you maturity benefits in addition to protecting your life. The simplicity of paying premiums over a short period of time is provided by SBI Life Smart Platina Assure.

One of the best insurance options for those wishing to safeguard their family’s future is SBI Life Smart Platina Assure. At the conclusion of each insurance year, this plan offers Guaranteed Additions.

SBI Life Smart Platina Assure Eligibility

| name of insurance policy | SBI Life – Smart Platina Assure |

| minimum age of entry | 3 Years Note: In case the Life Assured is a minor, the Policy Commencement Date and Risk Commencement Date shall be the same and the Policyholder/Proposer may be the parent or legal guardian. This will be as per the Board approved underwriting policy. |

| maximum age of entry | 60 years |

| maturity age | 75 years |

| Basic Sum Assured | Minimum: 2,40,000 Maximum: No limit (as per Board approved underwriting policy) |

| Policy Term | 12 and 15 years |

| Premium Payment Mode | monthly/yearly |

| Premium Payment Term | 6 years for 12 year policy 7 years for 15 year policy |

| Official Website | SBILIFE.CO.IN |

Features of SBI Life – Smart Platina Assure

Options for easy and versatile premium payments

You have the choice to pay your premiums in a straightforward and adaptable manner with this insurance coverage. In other words, if you select a policy duration of 12 years, you are responsible for the first 6 years’ premiums. You must pay for the first 7 years if you select a 15-year policy term.

Assurance of addition

The annual premium you pay for this insurance plan includes a guaranteed addition of 5 or 5.5 percent. This sum is given to the insured upon maturity or, in the event of the insured’s passing, to the beneficiary.

| Annual Premium Slab | Guaranteed Addition Amount (per year) |

|---|---|

| less than 1,00,000 | 5% |

| more than 1,00,000 | 5.5% |

Premium payment option

In this plan, you have the option of paying premiums monthly or annually. So, the insured can select the method of premium payment that best suits him or her.

Policy loan

The insured may be eligible for a loan equal to 80% of the surrender value of the policy under the terms and circumstances of this insurance plan. Only after the policy has developed surrender value will a loan facility be made available.

SBI Life – Smart Platina Assure Benefits

Death Benefits

If the insured passes away after purchasing the insurance, the beneficiary of the insured will also receive the sum promised and the stipulated additional amount. This payout will be equal to either 10 times the yearly premium or 105 percent of the premiums paid up until the date of death.

Maturity benefit amount

If the life assured survives the policy’s term, the Guaranteed Sum Assured and Guaranteed Additions are paid to the insured at maturity.

Reduced paid-up value

If you are having financial problems of any kind and are unable to pay the plan’s additional payment, you can change the insurance into a low-cost plan rather than cancelling it. Your premium will be decreased as a result. But, you will receive a sure, small profit.

Tax Benefit

According to the Indian Income Tax Act’s regulations, you are excluded from paying taxes on the premium.

Grace period

You have a grace period of 30 days for the yearly premium and 15 days for the monthly premium under this policy if you are late paying the insurance premium.

What is the reduced paid-up value?

if the insured is having financial difficulties and is unable to pay further premiums. The insured might change this insurance into a low payment insurance policy rather than cancelling it. In which a constrained profit is assured while the premium is reduced.

Death Benefit for Reduced Paid-Up Policy: The death benefit for a reduced paid-up policy will consist of the accrued Guaranteed Additions in addition to the paid-up Amount Assured on Death.

Paid-up Sum Assured on Death – Guaranteed Sum on Death: X (multiply) Number of payments paid / Number of original premiums due

Maturity Benefit for a Reduced Paid-Up Policy: The Paid-Up Amount Assured + Guaranteed Additions at Maturity constitute the maturity benefit for a Reduced Paid-Up Policy.

Paid-up Sum Assured on Maturity – Fundamental Sum Assured X (multiply) Number of premiums paid/Total Original Premiums Due

At the conclusion of each policy year covered by this policy, Guaranteed Additions will continue to accrue. which will look like this:

| Annual Premium Slab | Guaranteed Addition Amount (per year) |

| less than 1,00,000 | 4.25% |

| more than 1,00,000 | 4.75% |

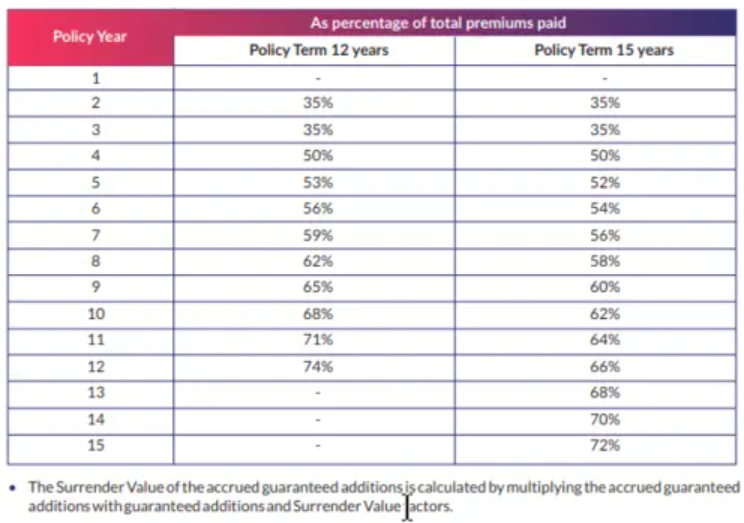

Surrender value

The insured is qualified to receive the surrender value if they have paid premiums for at least two years. During the insurance period, the insured may cancel the policy and get the surrender value.

The Guaranteed Surrender Value factors for various policy terms are listed below:

Grace Period

You receive a grace period of 15 days for monthly premiums and 30 days for annual premiums under this. If no premium is paid by the conclusion of the grace period, the insurance will lapse. The policy will continue to be in effect during the grace period.

Revival Benefit

If the policy expires for any reason, you have five years from the date of the first unpaid premium to reinstate it. In such circumstances, the Business must supply the requisite evidence upon request.

Free Look Period

You have 15 days from the day you received the policy document to return the policy document to the insurance provider if the terms and conditions or benefits of the policy do not meet your needs. Digital policies sold through distance marketing are subject to a 30-day free look period.