Table of Contents Show

What is the SBI Life eWealth Insurance Plan, who is eligible, what are the features, what are the advantages, what is the surrender value, what are the riders, and what is the grace period?, SBI Life eWealth Insurance Plan Details, eligibility criteria, features, benefits, rider, surrender value.

Many life insurance products are available from SBI Life. One of these is the online unit-linked plan Jeevan Bima e-Wealth Insurance Plan. The advantages of wealth creation and life insurance coverage are both provided by this plan. This insurance policy aids the insured in meeting his insurance requirements and accumulating wealth through alluring rewards. Understand this SBI Life eWealth Insurance Plan in depth.

What is SBI Life eWealth Insurance Plan?

A non-participating unit linked life insurance plan called SBI Life eWealth Insurance Plan provides both wealth growth and life insurance coverage. You can profit from market-linked gains with this plan thanks to the automatic asset allocation feature. You have the option of selecting between the Growth Plan and the Balanced Plan under this plan.

This kind of insurance plan enables the policyholder to maximise your money through alluring returns while securing his insurance demands. The strategy enables you to start with high-risk equities investments to maximise market-linked profits before progressively switching to lower-risk debt assets to protect your portfolio from short-term volatility or moving towards money market investments.

SBI Life eWealth Insurance Plan Options

Growth Plan

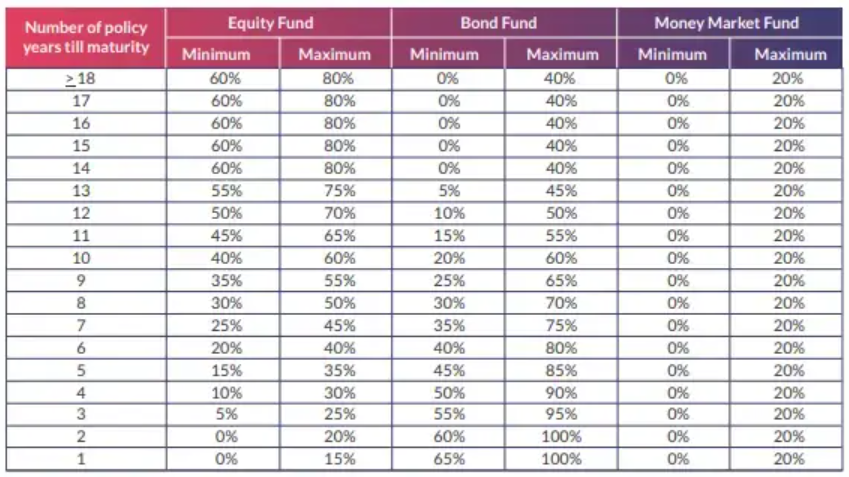

For the first few years of the policy’s term, this option’s high exposure aims for long-term equity returns that are reasonable. The equity exposure steadily diminishes and the debt/money market exposure gradually rises as the policy period lengthens.

Your premium is invested in equities funds, bond funds, and money market funds in varying amounts under this plan. as stated below

Balanced Plan

In comparison to the growth plan, the equity exposure under this plan option is less during the first few years of the policy term. Compared to a growth plan, a balanced method gives a larger investment for overall exposure to debt and the money markets.

Your premium is invested in equities funds, bond funds, and money market funds in varying amounts under this plan. as stated below

SBI Life eWealth Insurance Plan Eligibility Criteria

| Name of Insurance:- | SBI Life eWealth Insurance Plan |

| Entry Age:- | 5 to 50 years |

| Coverage (Basic Sum Assured):- | 10 times the annualized premium |

| Premium Paying Term:- | till the policy term |

| Policy Term:- | 10 to 30 years |

| Maturity Age:- | Minimum: 60 Years |

| Official website:- | www.sbilife.co.in |

Features of SBI Life eWealth Insurance Plan

The following are the main characteristics of the SBI Life eWealth Insurance Plan:

- Having both life insurance and market-linked returns has two advantages.

- Depending on his tolerance for risk, the policyholder may choose either a growth plan or a balanced plan.

The policy duration for eWealth insurance policies, which start at a monthly premium of Rs 2,000, ranges from 10 to 30 years. - Simple wealth management is offered, along with automatic asset allocation.

- Beginning with the sixth year of the insurance, you can make partial withdrawals.

- According to section 80C of the Income Tax Act, the premium you pay for this insurance will be eligible for tax breaks.

Under section 10 of the tax code, maturity benefits will also be eligible for tax breaks (10D).

Benefits of SBI Life eWealth Insurance Plan

Death Benefit

A death benefit equal to 105% of the minimum premium is paid upon the death of the policyholder, and the Fund Value or Sum Assured (whichever is larger) is paid for the active policy.

Maturity Benefit

After the insurance term has ended, if your policy is still in effect, you will get the fund value.

Tex Benefits

Section 80C of the Income Tax Act allows for a tax deduction on the premium of this policy. Under section 10 of the tax code, maturity benefits will also be eligible for tax breaks (10D).

Grace Period

For the payment of the annual premium, there is a grace period of 30 days. Likewise, if you pay a monthly premium, you will receive a 15-day discount. The policy will expire if the premium is not paid by the grace period’s deadline.

Surrender Benefit

Anytime during the insurance period, you can surrender your coverage and get your money back. But after being abandoned, the policy cannot be reinstated.

Revival

The policy expires if the premium is not paid during the grace period. The option to renew the insurance is offered by SBI Life eWealth Insurance within three consecutive years. That means that it starts to expire as of the first unpaid premium date and can only be revived up until the maturity date.

Free look period

The insurance may be returned within 30 days of the purchase date if the insured disagrees with any of the terms and conditions stated in the policy contract. You have 30 days to try out the SBI Life eWealth Insurance Plan without paying anything.